Did you know that certain donations are tax deductible in Singapore?

The pandemic has deepened the medical and financial needs of vulnerable communities. Through the generosity of kind donors, non-profit organisations in Singapore have been able to support them through this difficult time.

Even a small amount can make a difference. A donation of $10 can help to pay for five breakfasts for the elderly at nursing homes. $50 alone can fund 8 hospital trips for persons with disabilities, and $100 can provide meals for students in need.

This holiday season, find out how your donation positively impacts yourself and the ones you help.

Receive As You Give

Making a donation online is the simplest and most convenient form of giving. It allows you to support causes you believe in and helps improve the lives of those in need.

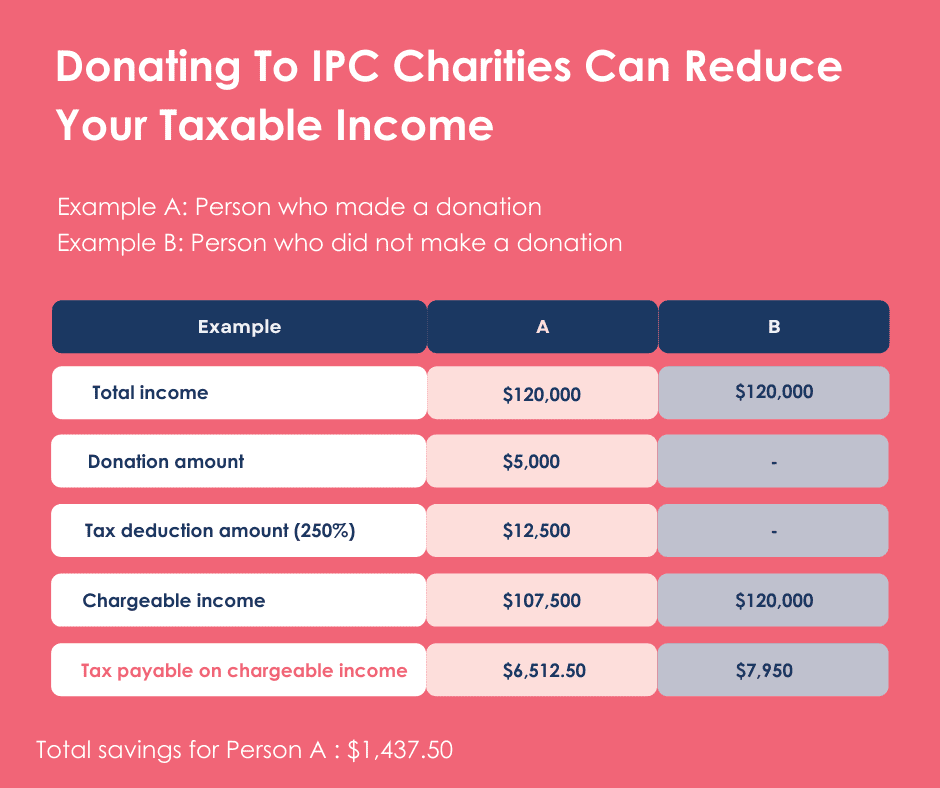

When you help others, your giving can help you too. If you donate to Institutions of a Public Character (IPC) charities, you can claim tax relief. Only IPC charities are approved by the Commissioner of Charities to receive tax-deductible donations, enabling donors to claim tax relief of 250% of their donation.

For example, if your total income is $120,000 this year, your income tax would be $7,950. However, if you donated $5,000 to an IPC charity during this year, your income tax would be reduced to $6,512.50, helping you save $1,437.50.

Tax deduction receipts are given for IPC donations. So when you donate, you can reduce your income tax at the same time.

The best part? After making your donation to an IPC charity, you do not need to submit any documentation to the Inland Revenue Authority of Singapore (IRAS)! The IPC charity will automatically forward your data to IRAS, to be included in your income tax assessment.

Be sure to make your donations by 31 December 2021, if you want it to be considered for FY2022 tax assessment.

Charities Receive 100% of Your Donations And More

With NVPC waiving transaction fees until 31 March 2022, you have more reasons to give now. Without transaction fees, it means 100% of your donation will go to the charity you donate to.

Did you also know that charities will receive more than the amount you give? If you donate $100, the charity will receive $200. This is because the Tote Board and the Government have extended the Enhanced Fund-Raising (EFR) Programme which matches donations to eligible IPCs, dollar-for-dollar.

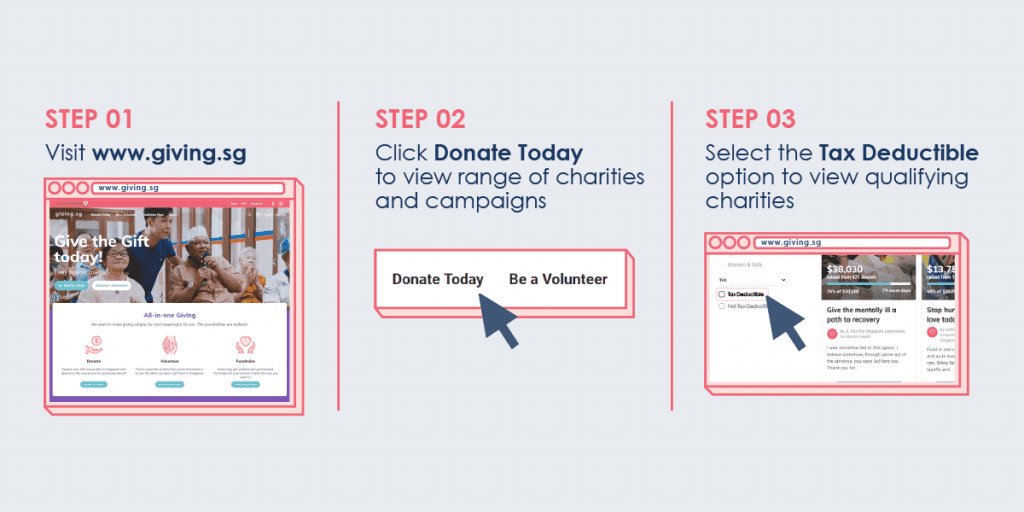

How to Find IPC charities on Giving.sg

Celebrate the season of giving by maximising your donations on Giving.sg or to any eligible IPC. Help communities and individuals at risk throughout the pandemic. In the process of caring and loving others, you can bring joy to both yourself and the person receiving it.

Here is how you can find IPC charities on Giving.sg:

1. Visit Giving.sg page

2. Click ‘DONATE TODAY’

3. Click ‘FILTERS’ tab at the top left corner and scroll down to ‘TAX’. Select the ‘Tax Deductible’ option.

You may now proceed to browse for a charity of your choice to make a donation.

Other Ways To Give Back This Festive Season

Donating is not the only way to give back to the community. Volunteering your time can tangibly benefit other people too. Besides making a difference to the people around you, you have the opportunity to develop new skills, expand your social network and make new friends along the way! From crafting Christmas cards for children in need, to offering emotional support for a migrant workers’ crisis helpline, there are plenty of volunteering opportunities waiting to be explored on Giving.sg.